Reversal of Impairment Loss

Under US GAAP reversals. The technical definition of the impairment loss is a decrease in net carrying value the acquisition cost minus depreciation of an asset that is greater than the future.

Reversal Of Impairment Losses Annual Reporting

For assets carried at a revalued amount eg.

. For assets that are carried at cost the reversal of an impairment loss is recognised in profit or loss. Us IFRS US GAAP guide 717 Under the IFRS expected loss model the allowance is updated every period to reflect the current assessment of expected losses. 1After recognition of the impairment loss at the end of 20X4 T revised the depreciation charge for the Country A identifiable assets from Rs.

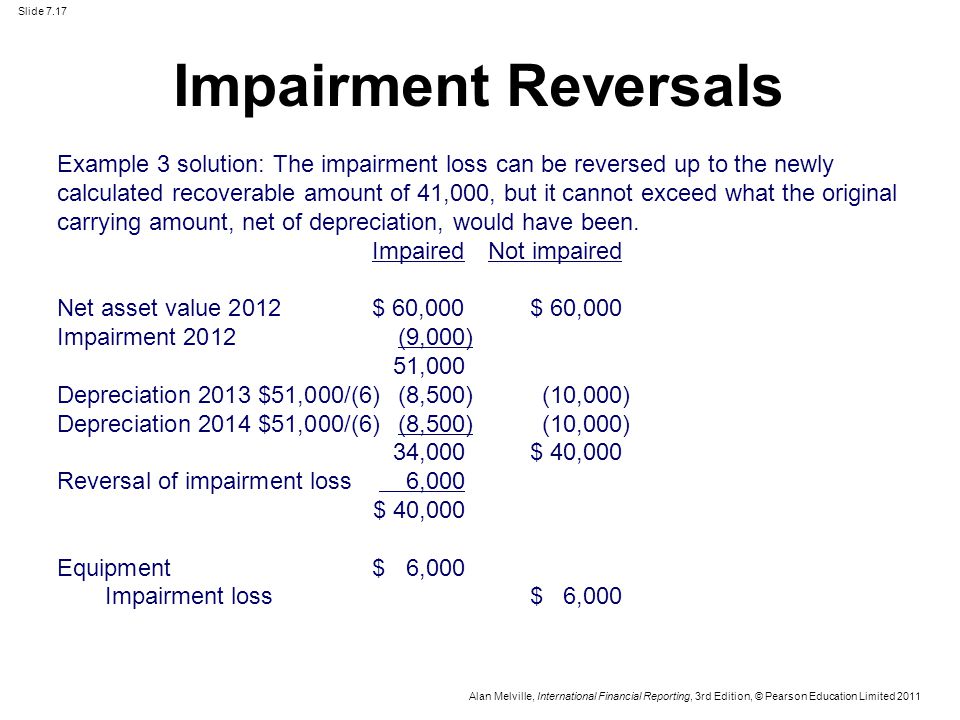

IAS 36121 Reversal of an. Reversal of an impairment loss is recognised in the profit or loss unless it relates to a revalued asset IAS 36119 Adjust depreciation for future periods. In general asset impairment.

Reversal of impairment losses of a disposal groups assets occurs when an asset held for sale is impaired but then revalues as follows. A The reversal of the impairment loss should be recognised immediately as income in profit or loss. The impairment loss should be reversed but only to the extent that it does not exceed the carrying amount that would have been determined had no impairment loss been recognised.

1333 lakhs per year to Rs. 115 A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or from sale since the date when an entity last recognised an. Fair value less costs to sell of.

Consistent with other US GAAP impairment guidance ASC 340-40 Other Assets and Deferred CostsContracts with Customers does not permit entities to reverse impairment losses. Reversal of an impairment loss for an individual asset You can reverse an impairment loss only when there is a change in the estimates used to determine the. Recognise or reverse any impairment loss The requirements for recognising and measuring impairment losses differ based on the structure of the.

B The carrying amount of the asset should be increased to its new recoverable amount. There is a bit of a problem here because when reversing an impairment we should not give an asset account an adjusted value greater than it would have been if we. A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or sale since the date when an enterprise last recognised.

Reversal of impairment is a situation where a company can declare an asset to be valuable where it has previously been declared a liability.

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

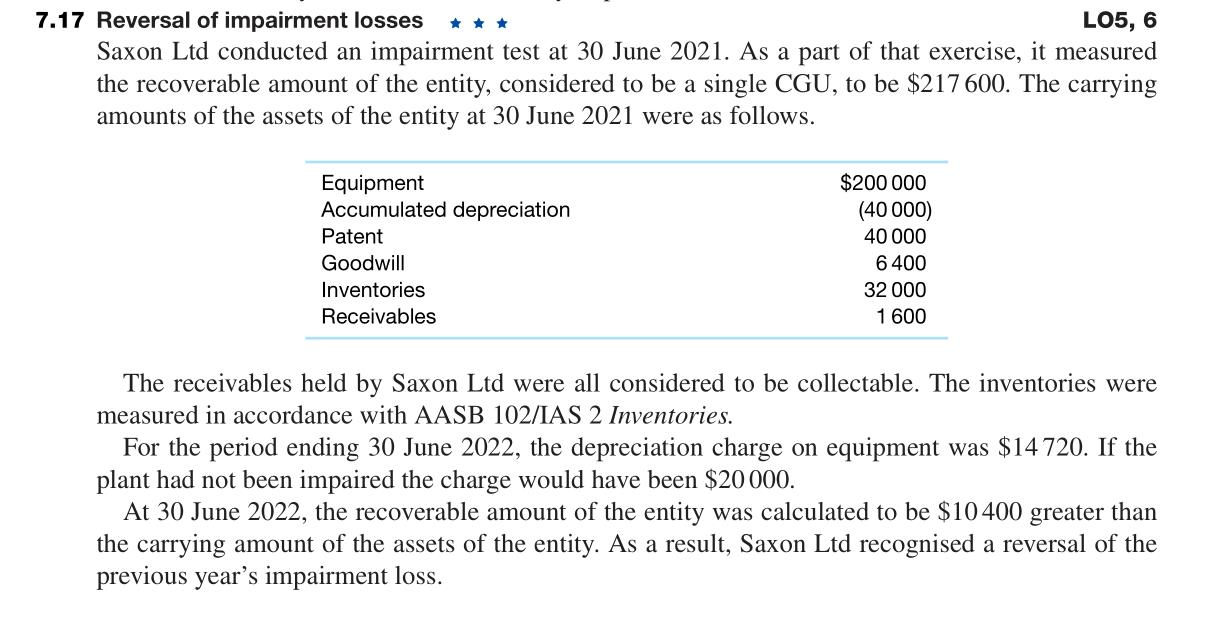

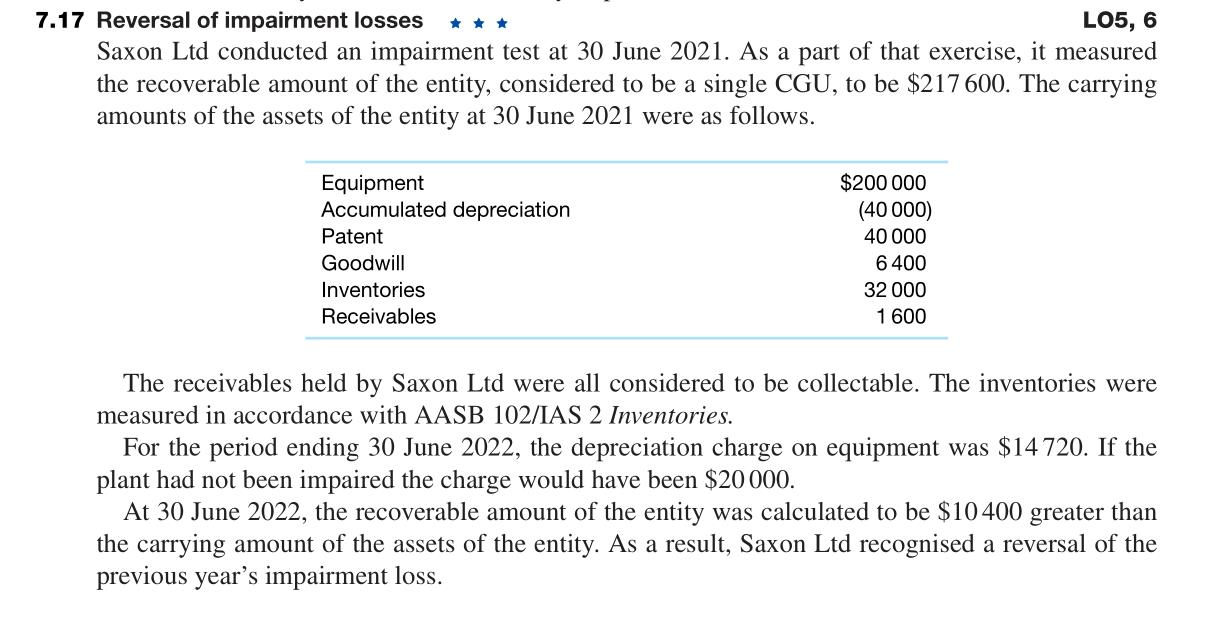

Solved 7 17 Reversal Of Impairment Losses Lo5 6 Saxon Chegg Com

Chapter 7 Impairment Of Assets Ias36 Ppt Video Online Download

Ias 36 Example Of The Reversal Of Impairment Youtube

0 Response to "Reversal of Impairment Loss"

Post a Comment